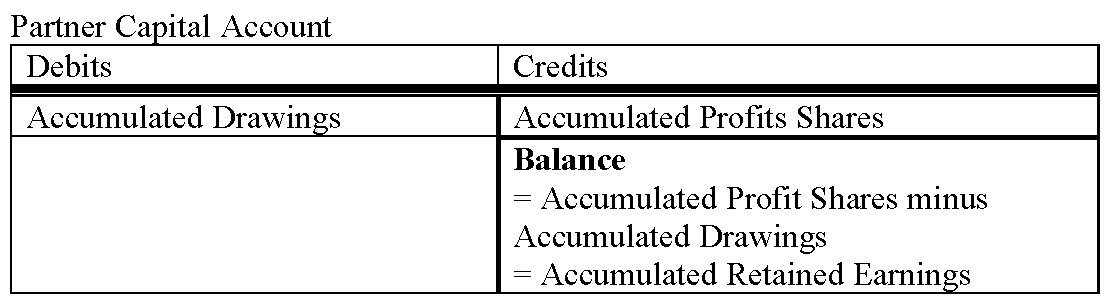

This paper explores the Employee Ownership Trust (EOT) model, comparing it with traditional partnerships and employee ownership structures like the US ESOPs and the European Coop-ESOPs. It primarily focuses on the crucial distinction of EOTs lacking internal capital accounts for employees due to common ownership and leading to what is termed a “horizon problem” where employees do not recoup their share of retained earnings. The “naked in, naked out” rationale, often used to justify this lack of individual accounts in EOTs, is easily refuted by noting that even professional partnerships described as “naked out” still pay off the partner capital accounts of exiting partners. Furthermore, the “first-cohort problem” is analyzed highlighting how initial employees in an EOT may effectively subsidize the acquisition debt without a mechanism to access their accumulated equity, potentially pressuring a future sale of the firm. Finally, EOTs are distinguished from democratic employee ownership since they have a form of trustee-ownership, where governance ultimately rests with a trust rather than with the employee-beneficiaries.

On Employee Ownership Trusts (EOTs)

October 30, 2025 by